Cheque truncation system (CTS 2010)

CTS 2010 is the prescribed standard by the RBI for cheques issued by all the Indian banks to facilitate faster clearing. Instead of the collecting branch sending the physical cheque to the paying bank, an electronic image of this cheque with relevant information like the MICR code, date of presentation, presenting banks etc.. is transmitted to the drawee branch by the clearing house, hastening the entire cheque clearing process.

In CTS, the presenting bank/branch captures the MICR band and cheque images using an Image Capture System comprising a scanner, Core Banking Solution and/or other applications. Presenting and paying banks have an interface/gateway called Clearing House Interface (CHI), which enables banks to transmit images and data in a secure manner to the clearing house.

The presenting bank sends this digitally encrypted and signed data with captured images to the clearing house, where this data is processed, a settlement figure arrived at and the images and data routed to the paying banks. This is called presentation clearing. The drawee banks receive data and images for processing the payment the return file for instruments that are unpaid.

The RBI deadline for all banks to ensure that all non CTS-2010 standard cheques are withdrawn and replaced with CTS-2010 standard cheques has been extended to july 31, 2013. Non CTS-2010 standard cheques that are presented beyond the extended period will continue to be accepted but will get cleared at less frequent intervals.

The only changes customers need to incorporate while using the new cheques are:

CTS 2010 is the prescribed standard by the RBI for cheques issued by all the Indian banks to facilitate faster clearing. Instead of the collecting branch sending the physical cheque to the paying bank, an electronic image of this cheque with relevant information like the MICR code, date of presentation, presenting banks etc.. is transmitted to the drawee branch by the clearing house, hastening the entire cheque clearing process.

In CTS, the presenting bank/branch captures the MICR band and cheque images using an Image Capture System comprising a scanner, Core Banking Solution and/or other applications. Presenting and paying banks have an interface/gateway called Clearing House Interface (CHI), which enables banks to transmit images and data in a secure manner to the clearing house.

The presenting bank sends this digitally encrypted and signed data with captured images to the clearing house, where this data is processed, a settlement figure arrived at and the images and data routed to the paying banks. This is called presentation clearing. The drawee banks receive data and images for processing the payment the return file for instruments that are unpaid.

The RBI deadline for all banks to ensure that all non CTS-2010 standard cheques are withdrawn and replaced with CTS-2010 standard cheques has been extended to july 31, 2013. Non CTS-2010 standard cheques that are presented beyond the extended period will continue to be accepted but will get cleared at less frequent intervals.

The only changes customers need to incorporate while using the new cheques are:

- Use image-friendly, dark-coloured inks while writing the cheques.

- Avoid alterations or corrections and if inevitable, use a fresh cheque altogether.

Cheques for CTS 2010

CTS-2010 standard cheques have been introduced in the country to standardize cheques issued by banks and reduce incidence of fraud.

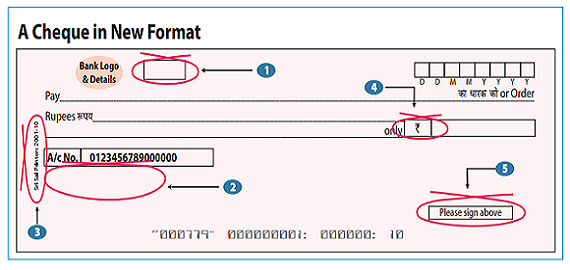

The new cheque format must display these security features:

1. The bank logo must be printed with invisible ink (ultra-violet ink) and branch address along with IFSC code printed beside it, on top of the cheque.

2. A photocopy of the cheque should display a pantograph below the account number that reads"VOID/COPY."

3. Cheque printer details with CTS-2010 must be displayed on the left side of the cheque.

4. The new rupee symbol should precede the "amount in figure"field.

5. "Please sign above" must be mentioned on the bottom right side of the cheque.

Some others security features include:

1. Date in dd/mm/yyyy format with boxes.

2. Watermark "CTS INDIA" to be visible when cheques in held against a light source.

1. Fresh CTS-2010 compliant cheques will have to be issued for all post dated cheques issued previously.

2. All cheques issued after July 31, 2013, need to be CTS-2010 compliant.

1. Quicker cheque clearance and settlement process with shorter clearing cycles and faster credit of money into an account

2. Reduced cost of storage - electronic storage is considerably cheaper.

3. No fear of cheques being lost in transit, since cheques will not be physically transferred.

4. Proposal to integrate clearing locations of all banks regardless of their locaion, resulting in a standard clearing system across India, enabling cheque clearances within 24 hours

5. Easy detection of fraud by intercepting alterd and forged instuments which pass through the electronic imaging system.

6. Improved operational efficiencies of our banking system resulting in better customer service and liquidity position for customers.

The new cheque format must display these security features:

1. The bank logo must be printed with invisible ink (ultra-violet ink) and branch address along with IFSC code printed beside it, on top of the cheque.

2. A photocopy of the cheque should display a pantograph below the account number that reads"VOID/COPY."

3. Cheque printer details with CTS-2010 must be displayed on the left side of the cheque.

4. The new rupee symbol should precede the "amount in figure"field.

5. "Please sign above" must be mentioned on the bottom right side of the cheque.

Some others security features include:

1. Date in dd/mm/yyyy format with boxes.

2. Watermark "CTS INDIA" to be visible when cheques in held against a light source.

1. Fresh CTS-2010 compliant cheques will have to be issued for all post dated cheques issued previously.

2. All cheques issued after July 31, 2013, need to be CTS-2010 compliant.

1. Quicker cheque clearance and settlement process with shorter clearing cycles and faster credit of money into an account

2. Reduced cost of storage - electronic storage is considerably cheaper.

3. No fear of cheques being lost in transit, since cheques will not be physically transferred.

4. Proposal to integrate clearing locations of all banks regardless of their locaion, resulting in a standard clearing system across India, enabling cheque clearances within 24 hours

5. Easy detection of fraud by intercepting alterd and forged instuments which pass through the electronic imaging system.

6. Improved operational efficiencies of our banking system resulting in better customer service and liquidity position for customers.

Cheque truncation system (CTS 2010)

Reviewed by Rayapalli suresh

on

22:47

Rating:

Reviewed by Rayapalli suresh

on

22:47

Rating:

Reviewed by Rayapalli suresh

on

22:47

Rating:

Reviewed by Rayapalli suresh

on

22:47

Rating:

.jpg)

No comments: